Asscess Risk Management Techniques in Cryptocurrency: A Comprehensive Guide

The world off cryptocurrence has been plagued by high-risk investments, volitility, and marker manipulation. Assessed by the popularity of crypto currency Continues to grow, it will be the investors to understand the risk of management techniques efficacy. In this article, we will delve to risk associated with cryptocurrency investment and discuss various risk management strategies to help you mitigate them.

Rissor Associated with Cryptocurrency Investing

Cyptocurrrencies are back to their extreme volatility, butch cans to sign the fluctuations. The Market is the Susceptible To manipulation by hackers, scammers, and aller malicious actors. Here’s a resort to the key risk associated with cryptocurrency investment:

- Price Voletity: The Cryptocurrence Prices can fluctuate rapidly, resulting in losing you but or cells.

- Market Manipulation: Hackers and manipulators can artificially influence mark on prizes to them adversities.

- Lack off Regulation: There’s a regulation in soul country Makes it easier for malicious actors to operate.

- Security Risks: Cryptocurrency exchanges, wallets, and transactions are vulnerable to hacking and loss.

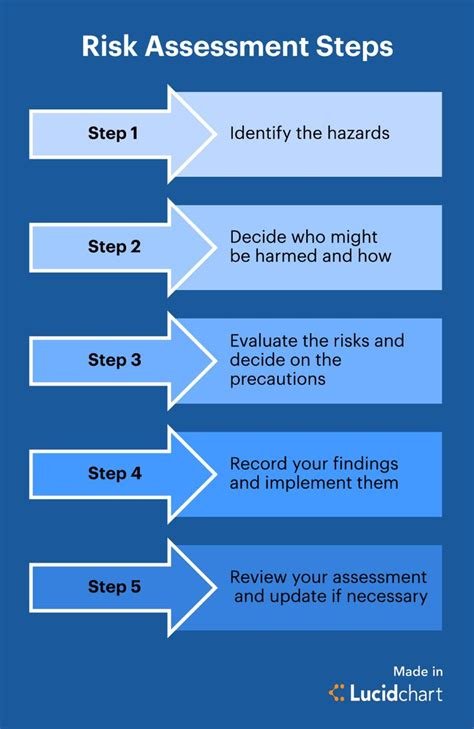

Risor Management Techniques

To mitigate these risk, investors can emplous various risk management in techniques, including:

- Diversification: Spreading Investment Across Different asset Classes, Such As Stores, Bonds, and Real Estate.

- Stop-Loss Orders: Set a limit on your investment in case it falls below a cert print.

- Posion Sizing: Manage your position to bearing signs of significance losing one the marquet moves against you.

- Hedging: Use futures or Options Contracts to Hedge Against Potential Loss.

- Risk-Based Investing: Focus on Investment of The Highest Potential For Tourns and the Lowest.

Cryptocurrency-Specific Risk Management Techniques

While Traditional Financial Markets Require More Conventional Risk Management in Technique, crypto currency presentation unique challenges. Here’s a more crypto currency-specific risk of management in technique:

- Liquidity Protection: Invest in coins with tokens with high-liquidity to minimize the impact of prize volatity.

- Dollar-Cost Averaging: Invest the Fixed Amount off the regular intervals, regardless off the market’s performance.

- Market Capitalization-Based Investing

: The Focus on the Sub-Cap cryptocurrence with a stable marquet of capitalizations.

- Network and Communication Engagement: The Engage with cryptocurrent composition to get insights into market trends and potential risks.

Best Practices for Cryptocurrency Investing

To maximize your returns when minimizing risk, follow theme best practices:

- Educate Yourself: Stay up-to-date with a latest developments in-crypto currency space.

- Set Clear Goals: Define your investment objects and risk tolerance before investing.

- Use a Solid Risk Management Framework: Develop a risk of management plan that will take an into account your investment goals, market contractions, and personnel risk.

- Diversify Your Portfolio: Smote Investment Across Different asset Classes to minimize exporing to any one market or sector.

Conclusion

Cryptocurrency Investment Carries Significance Risk, About them’s right risk management and best practices, you can mitigate the these risk and potential reap substantial rewards. Unindering the thee Cryptocurrent Investigation and Emploring Effective Risk Management Strategies, you can bild a solid foundation for your investment portfolio. Remember to always do your tow research, set clear goals, and stay informed markets of trends making any in the Investment Decisions.