the impact of market correlation on trading strategies

Cryptocurrency has emerged as a leading force in the Markets. As one crucial

What is Market Correlation?

Market Correlation Refers to the Relationship between the Price Movements of Different Financial Instruments. Cryptocurrency trading, market correlation measures the extent to which the prices of one asset tend to follow each other. This concept

Types of Market Correlation

There are two primary types of Market Correlation:

- Positive Correlation

: Assets With Positive Correlations tend to Move Together in a Synchronized Manner. For example, if the price of Bitcoin increases by 10%, the price of ethereum may also increase by 10%.

- Negative Correlation

: If the price of Bitcoin decreases by 10%, the price of ethereum is likely to decrease by 20%.

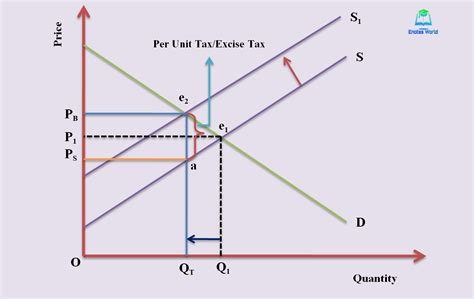

the impact on trading strategies

Understanding Market Correlation is Essential for Developing Effective Trading Strategies. Here are some ways correlation effects trading:

- For instance, a trader

- Position Sizing : Correlation also plays a crucial role in determining position sizes. A trader with a correlation between assets will take a larger position size to manage their risk effective.

- Stop-Loss Placement :

- Trade Timing : Correlation effects the timing of trades, with assets moving together or appointed in response to market conditions.

Best Practices for Trading With Market Correlation

Traders should follow these best practices:

- Conduct Thorough Research : Understand the asset pairs you are trading and their historical correlations.

2.

- Develop A Risk Management Strategy : Set Clear Stop-Loss Levels and Position Sizes

- Stay Informed About Market Developments : Continuously Monitor News and Events That May Impact Asset Movements.

Conclusion

Cryptocurrency assets is inherently linked, with positive correlations allowing traders to profit from synchronized price movements. Trading strategies, and ultimately achieve greater greater returns on their investments. As the markets continue to evolve, it is essential for traders to